Adjusted gross income

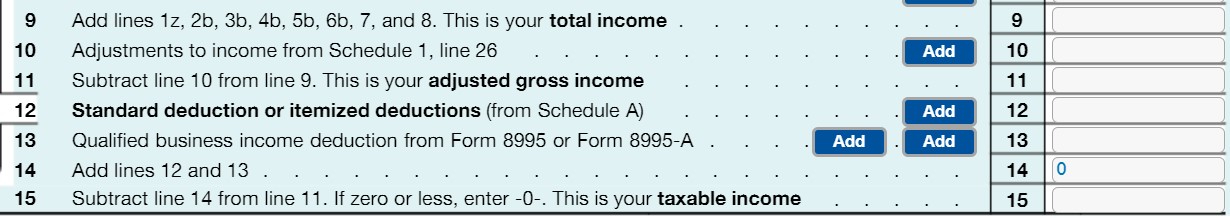

Your adjusted gross income (AGI) is your total (gross) income from all sources minus certain adjustments listed on Schedule 1 of Form 1040. Your AGI is calculated before you take your standard or itemized deduction on Form 1040.

Tax software calculates your AGI for you.

On this page

When you need your AGI

You may need your AGI to:

- Confirm your identity when you e-file your return

- Qualify for tax credits and other benefits

How to calculate your AGI

Start with your total (gross) income from all sources. This includes wages, tips, interest, dividends, capital gains, business income, retirement income and other forms of taxable income.

From your gross income, subtract certain adjustments such as:

- Alimony payments

- Educator expenses

- Certain business expenses – reservists, performing artists, fee-based government officials

- Deductible HSA contributions

- Deductible IRA contributions

- Moving expenses – military only

- Deductible self-employment taxes

- Penalties on early savings withdrawal

- Retirement contributions

- Student loan interest

Find all allowable adjustments on Part II of Form 1040 Schedule 1, Additional Income and Adjustments to Income PDF.

Your income:

- $50,000 wages

- $12,000 rental income

- $8,500 wages as a part-time Uber driver

- $500 bond interest

Your gross income = $71,000

Adjustments from gross income:

- $250 educator expenses

- $2,500 student loan interest

Your total adjustments from gross income = $2,750

Your AGI is $68,250. It’s your total income ($71,000) less your total adjustments ($2,750).

Where to find your AGI

Your AGI is on Form 1040, U.S. Individual Income Tax Return, line 11.

You can find last year’s AGI:

- In your Online Account

- On last year’s tax return – request a copy

)

or https:// means you've safely connected to the .gov website. Share sensitive information only on official, secure websites.

)

or https:// means you've safely connected to the .gov website. Share sensitive information only on official, secure websites.